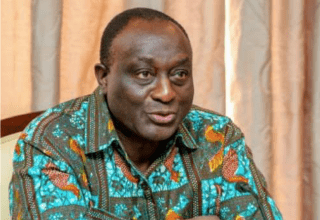

Mr Haruna Iddrisu, Minority Leader in Parliament, Tuesday, said the next National Democratic Congress (NDC) Government will abrogate the Agyapa Royalties Agreement.

He said the NDC Minority would put the London Stock Exchange and the Financial Conduct Authority on notice that the Agyapa Agreement did not meet the required due diligence and transparency, and that a substantial level of conflict of interest ran through the structuring of the agreement.

He said the Agreement did not meet the minimum requirement of Ghana’s Constitution and that a lot of things about it were still shrouded in secrecy.

“This agreement, is therefore, tainted with some corrupt acts,” Mr Iddrisu stated at the NDC’s 12th Weekly Meet the Press Series in Accra.

The Minority Leader recalled that on Friday, August 14, the last day of the second meeting of the Fourth Session of the Seventh Parliament, President Nana Addo Dankwa Akufo-Addo caused seven agreements relating to the Minerals Income Investment Fund (MIIF) to be laid before Parliament for approval.

He said the agreements sought to mortgage Ghana’s future mineral royalties and long term national assets in perpetuity without any regard to its implication on future national revenue streams.

“Through this transaction, the Akufo-Addo Government intends to use a Special Purpose Vehicle (SPV), Agyapa Royalties, incorporated as an offshore company in Jersey, in the Channel Islands, a known tax haven, in exchange for an upfront amount of $500 million, under the Mineral Development Fund Act, 2018 (Act 978) and its amendment Act, which strangely, was yet to be assented to by the President in accordance with Article 106 of the 1992 Constitution to make it law,” Mr Iddrisu said.

“The Government of Ghana will own 51 per cent of the shares of the Company and remaining 49 per cent floated on the London Stock Exchange.”

He said that Members of Parliament had less than four hours to scrutinise these agreements and ascertain the extent to which they would enhance the welfare of the people of Ghana and, in particular, its ramifications on national revenue into the future.

“Paradoxically, the Akufo-Addo Government claims to have used two years to prepare these agreements and yet, the people’s representatives in Parliament were required to peruse and approve same in less than four hours.”

He said the NDC Minority in Parliament, took a strong position in the national interest that the haste with which these high-stakes agreements were being rushed through the parliamentary approval process did not augur well for the important exercise of Parliamentary oversight on an issue as critical as the mortgaging of the gold royalties of the country in “perpetuity”.

However, as the representatives of the people of Ghana, it was their duty to ensure that such agreements met key legal legal and constitutional requirements before approval, he said.

He said the Minority, therefore, requested for the full complement of requisite documents to guide and facilitate a thorough scrutiny and due diligence of the proposed deal in accordance with article 185 of the 1992 Constitution.

Key amongst these requisite documents were the prospectus for the eventual sale of shares in Agyapa through an Initial Public Offering (IPO) on the London Stock Exchange and the prospectus would contain more important details of the deal such as projected cash flows, underlying assumptions and the dividend policy.

Others were the incorporation details for the SPV, Agyapa Royalties, detailed justification for the choice of Jersey, a known tax haven and fiscal impact assessment.

Mr Iddrisu said the Government refused to make these key documents available to them on the excuse that they were in a draft form and for reasons of confidentiality, could not to be shared.

He said this decision of the Government was in clear violation of Article 181(5) of the Constitution, which required that such documents together with the agreements be laid before Parliament for approval.

“As a direct consequence of this concealment of vital information from the people of Ghana, the debate on the floor of Parliament was extremely acrimonious, and eventually, the Members of the Minority in Parliament were compelled to stage a walk out as a clear statement of our intent to protect the national interest at all cost.”

He said the Minority in Parliament would like to state unequivocally that a future NDC Government would not honour the terms of “this unconscionable agreement.”

Mr Iddrisu said the NDC viewed strongly the decision to mortgage Ghana’s future mineral royalties in perpetuity was grossly inimical to the interest of the people of Ghana and ran contrary to the constitutional imperative that governmental power be exercised for the welfare of the people of Ghana.

He said the deal failed to enhance public welfare, adding that their analysis shows clearly that Ghana stood to lose billions of United States dollars in revenue as annual gold royalties from the mining sector amounted to about $200 million on the average.

He said it made no economic sense, therefore, to mortgage these receivables to an opaque Special Purpose Vehicle (SPV) in exchange for an upfront amount of just $500 million.

Mr Iddrisu said the incorporation of Agyapa as an offshore company in Jersey, in the Channel Islands, a known tax haven, was worrying.

He said tax havens were generally known for their lack of transparency in matters of corporate governance such as disclosure of the beneficial ownership of the shares of companies.

“Tax havens are susceptible to money-laundering and thus elevate the risk of Ghana being listed as a money-laundering jurisdiction by international bodies such as the European Union and the United Nations.”

He said Ghanaians would recall that in May 2020, the European Union placed Ghana on its Anti-Money Laundering List (AML) but deferred the implementation date to October 1, 2020 due to the Covid-19 pandemic.

He said by setting up a sovereign wealth fund in a tax haven, the Government significantly elevated the risk of Ghana being considered as a money-laundering jurisdiction.

Mr Iddrisu said this was because individuals and businesses used tax havens such as Jersey to hide their income and wealth so as to avoid payment of taxes and general regulatory scrutiny of their business deals.

He said the European Union, the OECD and the United Nations used evidence of these offshore deals to rate countries on the effectiveness of their anti-money laundering regimes, including laws, regulations, policies, and other governmental actions.

With regard to the Minority’s concerns on off-budget transaction, Mr Iddrisu said the deal was intended to monetize gold royalties to fund the Budget and ought to have been reflected in the Budget Statement tabled for approval and subsequently enacted in the various Appropriation Acts for the 2020 Fiscal Year, stating that the deal did not reflect in the Budget Statement for the 2020 Fiscal Year.

Meanwhile, the Government has denied any wrongdoing, saying the initiative was to was intended to maximise the national mineral wealth and create more value along the gold value chain.

The Minister of Finance, Mr Ken Ofori-Atta, at a media conference on August 28, therefore, refuted claims that some government officials were seeking to use the Agyapa deal to enrich themselves by mortgaging the country’s future mineral royalties, adding, “That state-capture claim is false”.

The conference was to clarify some concerns raised by the Minority NDC and CSOs over the Agyapa agreement.

Mr Ofori-Atta said the Agyapa transaction would turn the gold royalties into multiple revenue streams for the country by virtue of listing on the London Stock Exchange and the Ghana Stock Exchange to raise funds upfront for infrastructural development.

“We must be creative in our quest to raise revenue for our development by giving direct access to our resources in a manner that is open, transparent and operates within laws that exist outside our country.

“It is time to re-imagine our future. We’re tired of being cheated by foreign companies and we are constraining ourselves from using the same vehicle they use to get funds upfront for investments.

“We must to maximise value of income that is due the Republic from the mineral wealth for the benefit of our citizens.

“We often fail to see the value in our mineral resources because when we’re assessing the effectiveness of our policies and legislations, we limit the extent of our expectations to our national borders.

“We take no interest in what happens to our resources when they leave our shores, and how they’re traded on the foreign markets and how companies leverage such resources to create cheap financing and use different ways to generate profit,”Mr Ofori-Atta stated.

Source: gna.org.gh