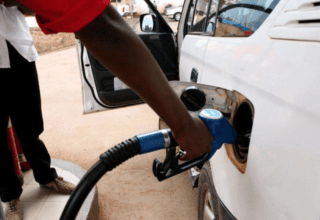

The University of Professional Studies, Accra (UPSA) has asked the government to reintroduce the luxury vehicle tax as a means of improving the country’s revenue generation.

“Government should consider reintroducing the luxury vehicle tax as a way of widening the tax base. A related area for consideration is the emerging gaming sector,” the UPSA suggested in its analysis of the 2021 budget statement.

The luxury vehicle tax was introduced during the 2018 midyear budget review by the then Finance Minister, Ken Ofori-Atta.

In 2019, it was however scrapped through the Luxury Vehicle Levy (Repeal) Bill after several concerns.

UPSA also advised the government to begin taxing small and medium-sized enterprises to improve revenue generation.

“Small and medium-sized online businesses are soaring, which are important sources of revenue for government. Government must therefore find creative ways of taxing these businesses to improve its revenue generation.”

The UPSA’s suggestion comes in the wake of Ghana’s ballooning debt stock which has largely been blamed on the impact of the COVID-19 pandemic.

The total public debt has increased from GHS122 billion, which is 69% of GDP to GHS291.6 billion, which is 76.1% of GDP, as of the end of December 2020.

The government has expressed its willingness to steer the affairs of the country in a way that will revitalize the economy.

It has thus introduced some new taxes and reviewed others upwards.

UPSA believes the measures listed below will also complement the government’s efforts in reducing Ghana’s debt stock:

- Tax compliance remains a major problem in the country, especially for the informal sector. One way to reduce tax evasion is to improve our tax compliance measures. This can be achieved by enhancing our digitization drive as a way of tracking revenues and tax collections in both formal and informal sectors. Education on tax compliance is also important.

- Among the revenue sources, grants seem to be the type with minimal economic consequences. However, grants are a small component of the revenue sources. Effort to improve on grants is important.

- Government must also ensure that leakages in the revenue basket are sealed, using technology and strengthening of revenue related public institutions.

- A continual improvement in the revenue administration should be a priority.

Source: citinewsroom.com