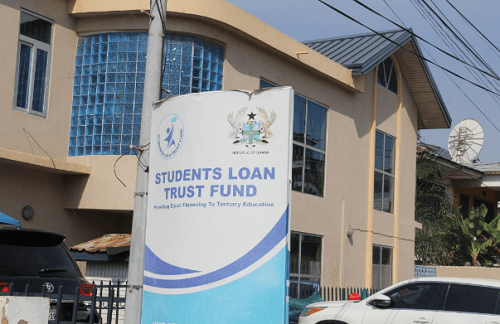

The Bank of Ghana (BoG) has included the Students Loan Trust Fund (SLTF) in the Credit Reporting System (CRS).

This means that details of students who borrow from the trust will be included in the credit reference bureau to keep their credit behaviour profile.

The measure is to boost the recovery efforts of the SLTF and also discourage borrowers from defaulting.

The Chief Executive Officer of the SLTF, Nana Kwaku Agyei Yeboah, told the Daily Graphic that the step taken by the BoG was a huge reprieve that would boost the fund’s loan recovery efforts.

“The BoG adding us as a Credit Reference System institution is in fact a big boost in our loans recovery efforts,” he said.

Measure

The measure, he said, meant that borrowers could build their credit worthiness and history “when they begin to pay back, thereby serving as an attraction to access other facilities such as bank loans and mortgage in the future.”

Being part of the CRS will also enable the SLTF to get additional information and contacts of its borrowers to help in tracing to wherever they will be for repayment of the loans they took while in school.

Nana Yeboah explained that the benefits that came with being part of the CRS were quite enormous as borrowers could use that to become credit worthy so as to benefit from other services.

The CRS is a database established under Act 726 to promote the sharing of information on the credit history of debtors with lenders and other users of the system.

Credit information sharing is beneficial to both lenders and borrowers or debtors as it helps lenders or creditors better assess the credit risk of each borrower or debtor.

BOG

The BOG recently expanded the list of institutions to participate in the CRS established under the Credit Reporting Act, 2007 (Act 762) to include the SLTF.

The list of institutions required to participate in the Credit Reporting System (CRS) established under the Credit Reporting Act, 2007 (Act 726) has been expanded to include telecommunication companies and utility companies.

Some are retailers, mobile money operators, financial technology companies (FinTechs), government institutions that offer credit to msmes, institutions that provide identification documents, entities that supply goods and services on a post-paid or instalment basis, student loan schemes provided by private or government agencies and other entities that have relevant data and information that complies with permissible purposes of credit bureaus.

Repayment

The repayment of the loans, the SLTF CEO said, was very important since it was money that was paid back that was used to give loans to students entering tertiary institutions.

“If you don’t pay, it means other students cannot benefit and so this is very important,” Mr Yeboah said.

“Understanding the borrower’s credit history helps us prescribe the right collection strategies for them. For instance, at the Students Loan Trust Fund we have facilities like forbearance payment, deferment and interest rate reduction or wavers,” he said.

With the new development of adding the SLTF to the CRS, Mr Yeboah said the SLTF would undertake a financial literacy initiative for the students in the various institutions for them to understand it (development) since it was a new thing.

“Now we are going to educate them to let them understand the way Ghana is going, that it is better to guide your credit history,” he said.

No guarantor policy

Mr Yeboah said the trust fund was waiting for the government to give the go ahead for the no-guarantor policy to take off, saying that students would be educated about the no-guarantor policy when it took off.

He said apart from going to all the tertiary institutions to educate the students, the trust fund would use other means such ad social media, website, among others for easy access to information no matter one’s location.

“Now the GhanaCard will help us to identify the borrowers and track them better than the guarantor because in the past we were only working with the SSNIT database.

“The GhanaCard is synchronised with all other cards, so now we have access to more database that we can track the student from. So that would help us track the borrowers more alongside the CRS than we used to do with the guarantor, he said.”

Source: graphic.com.gh